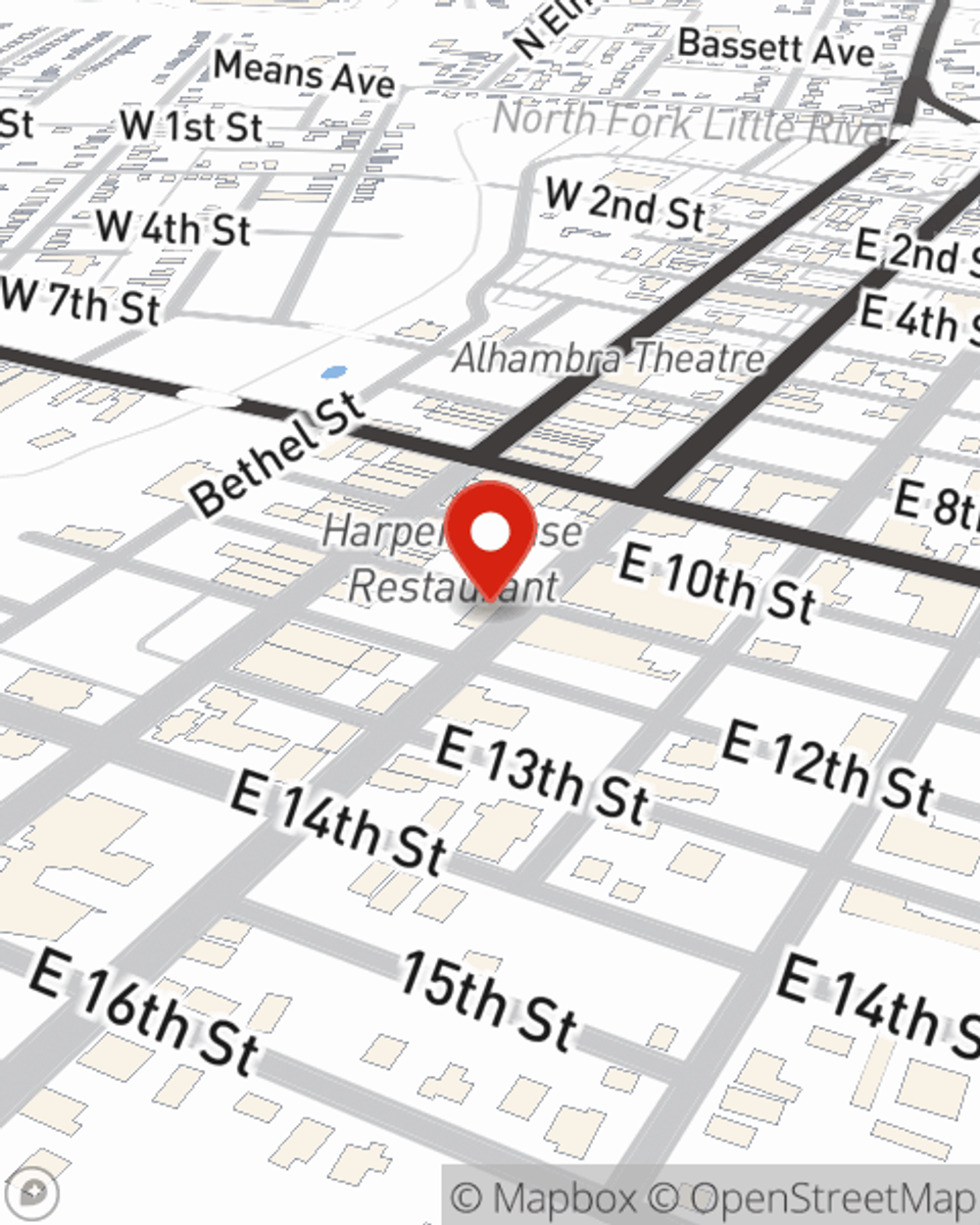

Auto Insurance in and around Hopkinsville

Hopkinsville! Are you ready to hit the road with auto insurance from State Farm?

Insurance that's the wheel deal

Would you like to create a personalized auto quote?

- Kentucky

- Tennessee

- Ohio

- West Virginia

Here When The Unexpected Arrives

Cracked windshields, flying objects and fire, oh my! Even the most experienced drivers know that sometimes mishaps occur. No one knows what to expect around the next bend.

Hopkinsville! Are you ready to hit the road with auto insurance from State Farm?

Insurance that's the wheel deal

Coverage From Here To There And Everywhere In Between

Wonderful collision coverage, emergency road service coverage, medical payments coverage, and more, could be yours with a policy from State Farm. State Farm agent Michael Venable can show you which of those coverage options, as well as savings options like the good driver discount and Drive Safe & Save™, you may be eligible for!

You don't have to ride solo when you have insurance from State Farm. Visit Michael Venable's office today for more information on the advantages of State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Michael at (270) 885-0063 or visit our FAQ page.

Simple Insights®

In the market for a classic car? Here's the buyer's guide you need

In the market for a classic car? Here's the buyer's guide you need

Buying a classic or antique car might be one of the most exciting purchases you'll make. Check out some helpful tips to help you through the process.

Staying safe at railroad crossings

Staying safe at railroad crossings

It may be tempting to accelerate or drive across the railroad tracks against the signal but the risk is too high. Use common sense.

Michael Venable

State Farm® Insurance AgentSimple Insights®

In the market for a classic car? Here's the buyer's guide you need

In the market for a classic car? Here's the buyer's guide you need

Buying a classic or antique car might be one of the most exciting purchases you'll make. Check out some helpful tips to help you through the process.

Staying safe at railroad crossings

Staying safe at railroad crossings

It may be tempting to accelerate or drive across the railroad tracks against the signal but the risk is too high. Use common sense.